michigan use tax exemptions

Buildings Safety Engineering and Environmental Department. The People of the State of Michigan enact.

Michigan Sales Use Tax Guide Avalara

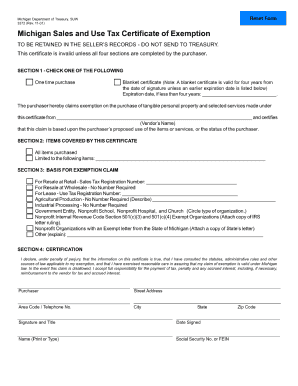

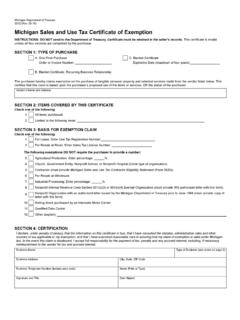

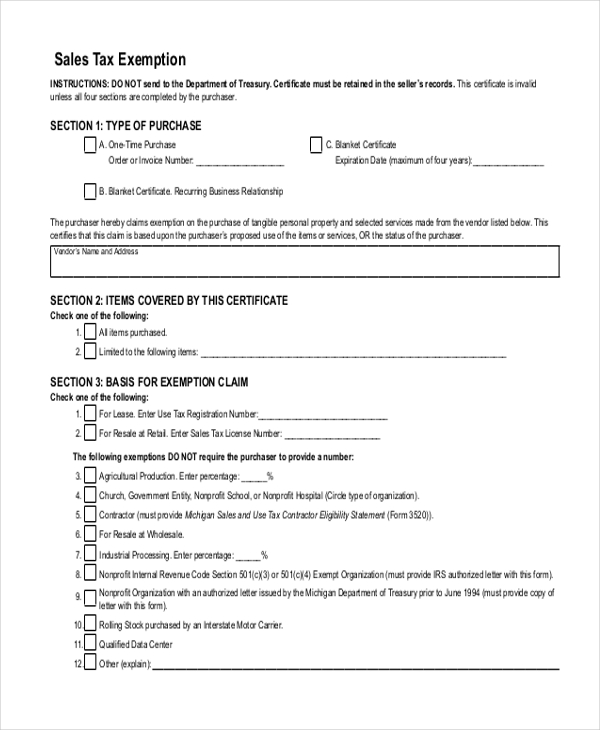

Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form.

. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Department of Treasury holding that the Michigan Use Tax apportionment rules apply in situations where property is simultaneously used for exempt and non-exempt. In order to claim exemption the nonprofit organization must provide the seller with both.

This page discusses various sales tax exemptions in Michigan. Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s to the State of Michigan. Notice of New Sales Tax Requirements for Out-of-State Sellers.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. For transactions occurring on and after October 1 2015 an out-of-state seller may be. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

Michigan Sales and Use Tax Contractor. Michigan Department of Treasury 3372 Rev. Nonprot Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization.

Michigan Sales Tax Exemptions. The Michigan Sales and Use Tax Exemption Certificate can be used to purchase any of the tax exempt items in Michigan. Streamlined Sales and Use Tax Project.

Printable Michigan Sales and Use Tax Certificate of Exemption Form 3372 for making sales tax free purchases in Michigan. 2022 Michigan state use tax. History1937 Act 94 Eff.

Use tax is a companion tax to sales tax. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in. Sales and Use Tax Exemption Claim Procedures and Formats.

Nonprot Organization with an authorized letter issued by Michigan. Civil Rights Inclusion Opportunity Department. This exemption claim should be completed by the purchaser provided to the seller.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable.

Sales tax exemption is to be used exclusively to make purchases for use by Michigan Technological University and is not for personal use by individuals faculty staff or. Michigan is uncommon in having only one Tax exemption. 20591 Use tax act.

This act may be cited as the Use Tax Act. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some. Department of Public Works.

November 1 2022 Replaces Revenue Administrative Bulletin 2021-18 RAB 2022-19. When delivery is outside Michigan states may grant an exemption from sales and use tax on purchases made by the University of Michigan. The MI use tax only applies to certain purchases.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Use Tax Exemption on Vehicle Title Transfers. States that provide exemptions can be.

What is Exempt From Sales Tax in Michigan.

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Download Business Forms Premier1supplies

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Michigan Property Tax Exemption Form Videos Oceanhero

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption Fill Out Sign Online Dochub

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

3372 Michigan Sales And Use Tax Certificate Of Michigan Department Of Treasury Pdf4pro

Michigan Tax Agreement Benefits Pokagon Band Of Potawatomi

Customer Forms Lasting Impressions

Michigan Veterans Property Tax Exemption Form 5107 Fill Out Sign Online Dochub

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Tax Exemption Guidelines Newegg Knowledge Base

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions